Ignore it and risk irrelevance

In today’s fast-paced and complex governance environment, the traditional annual board work plan remains a useful tool for structuring routine responsibilities, such as scheduling board evaluations and policies reviews, and approving annual financial statements and budgets.

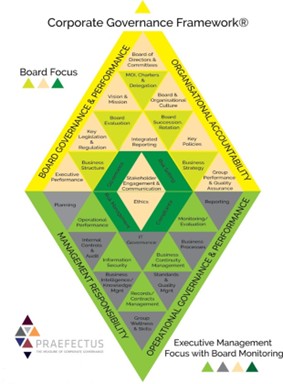

However, its largely static nature often fails to capture the fluid realities of modern governance. A digitised Corporate Governance Framework® (Figure:1) complements these plans by providing real-time, data-driven insights that help company secretaries and boards identify emerging issues, prioritise strategic discussions and adapt agendas proactively, ensuring timely, and informed decision-making.

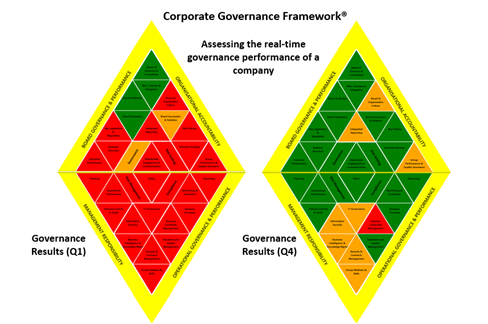

Through evolving dashboards, performance metrics, and visual schematics, digitised governance frameworks offer directors and executives immediate visibility into governance health. Real-time metric scoring -- often reflected in a RAG (red, amber, green) status -- enables sharper boardroom discussions, strengthens oversight, and empowers key stakeholders, including directors, management, company secretaries, and institutional investors. Crucially, these systems can also help identify early warning signs that, if acted upon, may prevent governance failures before they escalate.

Real-time data: The new boardroom backbone

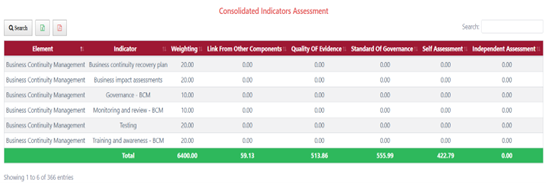

Digitised governance frameworks empower directors and executives with online access to real-time dashboards ensuring that board agendas reflect current governance realities, not outdated reports. This agility is vital in a world where market forces and stakeholder expectations shift rapidly. Visual schematics, such as the Consolidated Indicators Assessment, map the RAG status to real-time metric scores, which are regularly updated by CEOs, C-suite leaders, and departmental heads, and independently validated for objectivity.

For example, the shift from red-dominated Q1 visuals to greener Q4 (Figure: 2) governance performances across a company illustrates how timely data effectively tracks the organisation’s governance performance over time. Similarly, governance trends across different companies can also easily be monitored over varied, or specific times.

With early adoption still in its infancy, digitised governance technology is gaining traction among forward-thinking organisations and signalling a revolution in governance practices globally.

Company secretaries are increasingly moving beyond static information sources, recognising that rigid and static board work plans can undermine board effectiveness, relevance, and even long-term organisational resilience. The RAG system, linked to core governance metrics such as Board & Organisational Culture or Board Evaluation for example -- as illustrated in the self-assessment schematic (Figure: 3) -- brings objectivity to areas previously clouded by ambiguity.

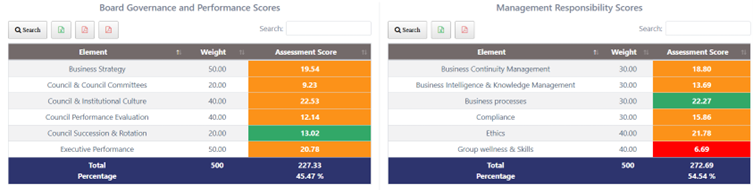

This governance technology enables directors to maintain the ‘nose in, hands out’ oversight approach (as suggested by Professor Roy Shapira, an Olin Corporate Governance Fellow and a Clark Byse Fellow from Harvard University) using real-time scores (Figure: 4) to prioritise agenda items and ensure that boardroom discussions focus on the most critical and timely governance matters.

Bolstering oversight with RAG metrics

Digitised governance frameworks, powered by RAG-status dashboards linked to real-time metrics (Figure: 4), significantly enhance oversight across all levels of an organisation. Directors gain a consolidated view of governance health, facilitating more effective risk mitigation and the prioritisation of resource deployment.

Visual tools like the Consolidated Indicators Assessment schematic spotlight key areas -- such as Key Legislation & Regulation, Integrated Reporting, Stakeholder Engagement & Communication -- and report red flags which prompt immediate attention, while green flags signals alignment with compliance expectations.

Executives, GRC specialists, and departmental heads, who input data and who are cognisant of the assurance vetting processes, are better able to align day-to-day activities with governance objectives, fostering real-time transparency as scores update dynamically.

The self-assessment schematic further tracks performance across areas like Board Committees, Vision, and Legislative Compliance, with the RAG status providing intuitive cues for performance oversight.

Institutional investors, increasingly demanding verifiable transparency, also benefit from this enhanced visibility. Whether an organisation is excelling or underperforming, inflated governance claims are easily challenged by consistently tracked metrics. In today’s market, trust hinges on authenticity and digitised governance frameworks offer the evidence investors require to support or step back from an organisation.

Practical lessons from governance demise

The value of technological advances in digitised governance frameworks is sharply illustrated by the collapse of major organisations, where real-time RAG metrics could have sounded early alarms. Enron’s accounting scandals, hidden behind manipulated financials, might have triggered red alerts in Internal Controls & Audit, including Business Processes. WorldCom’s overstated assets and Steinhoff’s fraudulent disclosures could have shown amber warnings, prompting timely board intervention. Lehman Brothers’ unchecked risk-taking, Carillion’s operational failures, and African Bank’s liquidity crisis may have surfaced red flags in Risk and Internal Controls metrics. Likewise, the governance breakdowns at VBS Mutual Bank and corruption at EOH Holdings could have been mitigated with clear, real-time indicators.

For example, Enron’s board might have acted sooner if quarterly updates had shown consistent red status in Reporting, Evaluation, and Internal Controls. Steinhoff’s delayed disclosures may have been pre-empted through transparent, continuously updated RAG dashboards. These high-profile failures highlight a core deficiency in traditional governance, underscored by the absence of dynamic, data-driven insight. When weaknesses go unflagged and unaddressed, collapse becomes inevitable (Figure: 5).

The stakeholder imperative in practice

When implemented effectively, a digitised governance framework serves all stakeholders by delivering essential, timely information, and thus functions as a highly practical collaborative governance tool. Directors use RAG metrics to enhance oversight, executives align daily operations with scored governance outcomes, and company secretaries manage dynamic governance data flows to meet modern demands. The self-assessment schematic’s detailed elements -- such as Board Succession and Integrated Reporting -- offer a practical blueprint, transforming governance from textbook theory into actionable strategy with measurable value and direct impact on the bottom line.

Informed institutional investors, in particular, rely on this transparency to assess an organisation’s long-term viability. The Consolidated Indicators Assessment’s RAG visuals provide a common language, ensuring stakeholders and the board see the same governance picture in real time. In an environment where organisational survival depends on relevance and credibility, those who ignore digitisation risk losing both trust and market confidence, as investors increasingly demand evidence over promises.

Bridging the textbook gap

While textbooks outline governance principles, they often fall short in delivering the practical tools needed for effective application. Digitised governance frameworks, particularly those powered by RAG systems and real-time metrics, bridge this gap by transforming theory into actionable insight. Schematics, such as those provided within the digitised governance framework, demonstrate how governance data evolves over time, offering a hands-on, dynamic approach to oversight that static plans simply cannot replicate. As adoption accelerates, these digital toolsets ensure boards move beyond compliance - becoming agile, informed, and ready to address challenges before they escalate into crises.

Conclusion

A digitised governance framework is no longer a luxury; it is a survival imperative for a broad spectrum of stakeholders. By delivering real-time RAG metrics that inform board and executive agendas, strengthen oversight, and ensure transparency, it transforms governance into a dynamic, data-driven process - one that was neither possible nor even imagined before the advent of such technology.

The evolution of dashboard schematics, from red to green, not only reflects governance improvement but symbolises the growing maturity of this digital approach. Far from a theoretical construct, it is already proving its value in progressive organisations and is on track to become a globally recognised standard. As its trajectory continues, digitised governance frameworks may soon hold a place in the governance ecosystem as ubiquitous as Microsoft Office in the productivity suite, far surpassing static guidance from frameworks such as ISO 37000 or the OECD’s governance papers. The era of digital governance has arrived, and with it, the tools to lead with confidence, clarity, and accountability.

ENDS

Words: 1,245

For further information contact:

Terrance M. Booysen (CGF: Chief Executive Officer) - Cell: +27 (0)82 373 2249 / E-mail: [email protected]

Jené Palmer (CGF: Director)) - Cell: +27 (0)82 903 6757 / E-mail: [email protected]

CGF Research Institute (Pty) Ltd - Tel: +27 (0)11 476 8261 / Web: www.cgfresearch.co.za

Follow CGF on X: @CGFResearch

Click below to read more...