A celebration worth reflecting on

The Chartered Governance Institute of Southern Africa (CGISA) hosted its annual Integrated Reporting Awards on 12 November 2025, marking yet another milestone in South Africa’s journey toward improved corporate transparency. Nedbank Group earned its 14th overall win -- an extraordinary achievement -- praised for clarity, innovation, and strengthened stakeholder engagement.

These awards, co-hosted with the Johannesburg Stock Exchange (JSE), have historically played an important role in benchmarking reporting quality. Business Day’s coverage (27 November 2025) commended the increasing maturity in integrated reporting, particularly in structured narratives and enhanced visual communication.

Yet, as South Africa transitions into the King V™ era, a deeper question arises:

Are current reporting award assessments truly a reliable indicator of good governance?

King V™’s context: Ethical leadership and technology-enabled transparency

King V™ extends the work of King IV™ by placing greater emphasis on ethical leadership, digital governance, assurance integration, and sustainable value creation. Its message is unequivocal in that governance disclosures must reflect verifiable performance, not merely aspirational statements.

The challenges identified during this year’s awards suggest that the reporting ecosystem will need strengthening before it fully aligns with these expectations. Judges highlighted:

- persistence of tick-box compliance;

- inconsistent risk and materiality disclosures;

- confusion around double materiality;

- lack of cohesion between sustainability ambition and actual performance; and

- reports often being too investor-centric and lacking the multi-stakeholder perspective.

These gaps raise broader concerns about how each organisation defines good governance and how these organisations measure and substantiate the achievement of their governance goals.

The consultant and presentation dynamic

Firms offering specialised integrated reporting support and services -- including design, drafting, digital layout and production -- provide significant assistance to organisations navigating regulation, and complex reporting frameworks. These services improve readability, communication, and stakeholder accessibility.

However, presentation quality can sometimes obscure the true underlying governance position. Recent empirical research shows that while integrated reports have become more compelling over time, the underlying business performance they describe does not always keep pace - meaning a report can look impressive even when the real outcomes lag behind. This creates a key dilemma in that reporting awards often prioritise narrative and visual excellence over independently verifiable evidence of the organisation’s governance performance.

Sponsorships, perception risks, and the role of judgement

Awards programmes make an important contribution to strengthening reporting practice, and operate with sincere intent and committed professionals. Yet, like most recognition systems globally, they face a number of structural realities that naturally shape outcomes.

One such reality is the challenge of ensuring completely objective judgement. Panels are typically composed of experienced professionals, but in many specialised fields, the community of available judges can be relatively small. This can result in recurring panels and shared perspectives, not out of bias, but because the talent pool is limited.

Criteria such as clarity, innovation, and storytelling rely on professional interpretation. While robust judging platforms often recommend mitigations -- including conflict disclosures, anonymised submissions, and structured scoring -- publicly available information suggests that evaluations still rely heavily on narrative-based assessment. Sponsorship arrangements, which are common across professional associations internationally, also create unavoidable perception risks, even where no improper influence exists. Governance bodies such as ASAE (American Society of Association Executives) and Transparency International note that these dynamics are universal features of reporting award ecosystems, not failings of any particular programme.

Another reality is that participation is voluntary, creating a naturally self-selecting pool of entrants. Many organisations participate repeatedly, resulting in a familiar set of reports for judges to evaluate. Incremental improvements may occur, but the overall standard of the entrant pool -- rather than the entire reporting landscape -- ultimately determines the level of excellence that can be recognised. In principle, if judging were based strictly on evidence-heavy criteria, some categories might occasionally yield “no award.” In practice, most recognition frameworks aim to acknowledge progress within the available pool rather than enforce absolute thresholds. This subjectivity becomes particularly relevant when reports are “quite difficult to separate winners and losers,” as noted in Business Day’s coverage of the mid-cap category.

Taken together, these dynamics reflect a common challenge across many award systems: the tension between recognising effort and rewarding true, evidence-based governance excellence. This is an observation of the broader ecosystem rather than a criticism of any reporting awards programme.

The case for digitised governance evidence

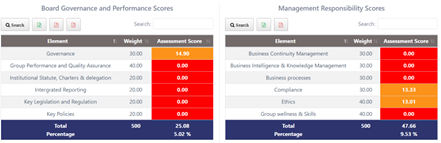

To move beyond these limitations, organisations and award bodies may benefit from digitised governance environments that capture governance activity continuously and transparently. Modern digital governance frameworks provide capabilities such as:

| i. | Evidence-backed governance indicators | ||

| Each performance rating links directly to traceable documentation, assurance reviews, risk responses, and decision trails. | |||

| ii. | Continuous tracking of governance activities | ||

| All governance actions, responsible individuals, and control activities are captured in real time. | |||

| iii. | Visibility into recurring weaknesses and root causes | ||

| Digital records highlight areas where governance breakdowns repeatedly occur, enabling stronger corrective action. | |||

| iv. | Improved internal and external audit alignment | ||

| Assurance providers assess the same evidence used to generate performance disclosures, reducing discrepancies or selective reporting. | |||

| v. | Longitudinal governance integrity | ||

| A digital environment prevents end-of-year governance report “construction,” creating a factual continuity year after year. |

These capabilities support King V™’s technology and assurance pillars, enabling a shift from self-reported governance to demonstrated governance.

Strengthening award credibility: A possible way forward

Award bodies could enhance the credibility and consistency of evaluations by ensuring judges give meaningful weight to whether entrants’ materiality assessments, ESG metrics, and governance disclosures are supported by independent assurance or verification. Judges are not expected to audit the underlying evidence themselves, but they can assess whether independent verification has been obtained, whether assertions appear reasonable, and whether reporting aligns consistently with recognisable standards and frameworks. This allows judges to better distinguish narrative gloss from substance-based governance quality.

Currently, reporting organisations rely predominantly on annual audit cycles with limited scope to provide assurance. This potentially increases the risk of subjective interpretation and undermines the comparability of reporting submissions. Past examples -- including organisations that were previously recognised despite later questions about the veracity of their compliance claims -- illustrate the reputational stakes for entrants, judges, and award organisers alike.

Studies in the public governance domain (PubMed 2022) show that digitisation and technology-enabled evaluation tools can strengthen oversight, increase transparency and stakeholder trust, and reduce information asymmetry.

While judges are not expected to review detailed evidence themselves, by encouraging entrants to demonstrate evidence-backed claims and adopt digital verification frameworks the judges can underpin the integrity, relevance, and credibility of the reporting awards.

Recommendations for an evolving awards framework

To align with King V™ and international good practice, CGISA might consider integrating the following into future award criteria:

| i. | Verified governance metrics | ||

| Require entrants to substantiate key performance indicators with evidence-based data derived from digital governance environments. | |||

| ii. | Independent governance verification | ||

| Confirm the extent to which governance claims have been confirmed by way of independent review. | |||

| iii. | Structured digital self-assessments | ||

| Encourage the use of recognised digital governance assessment tools -- (e.g. UNESCO’s Data Governance Toolkit: Navigating Data in the Digital Age (2025) -- to strengthen the rigour and consistency of governance claims and assertions included in the annual integrated report. | |||

| iv. | Transparency of criteria and sponsorships | ||

| Ensure comprehensive disclosure of how conflicts which may or may be seen to impact the judging of submissions are managed and how judging criteria are weighted. |

A necessary evolution

These awards have championed transparent disclosure since 1956, but in King V™'s era, they must evolve to incorporate the tangible factors that demonstrate an organisation’s impact on its wider stakeholder community.

As noted by the keynote speaker, Ramani Naidoo, true excellence isn't found in glossy reports - it's in verifiable, ethical actions. By embracing digital governance frameworks, South Africa can set a global benchmark, ensuring reporting awards reflect governance reality rather than governance aspiration.

Embedding digital verification and evidence-based assessment into the awards framework allows CGISA to reinforce its role not only as a promoter of governance excellence but as a catalyst for true accountability. As CGISA CEO Stephen Sadie concluded the 2025 Awards he said, “At CGISA, we don’t just teach corporate governance, we propel it forward.”

Sources:

- King V™ Code (IoDSA, 2025)

- UNDP Governance Framework (2025)

- OECD Digital Mapping Tool

- Business Day article – “Nedbank’s report sets new benchmark” (27 Nov 2025)

- Corporate governance, External Assurance and Integrated Reporting Practices: Empirical evidence from South Africa, Olayinka Adedayo Erin (2025)

- Integrated Reporting And Financial Performance Of Mining Companies Listed On The JSE: Evidence from South Africa, Nyasha Rebecca Dlamini (2024)

- The Value Of Integrated Reporting In South Africa, Maatabudi Mokabane & Elda Du Toit (2022)

- The Effects Of Integrated Reporting Quality: A Meta-Analytic Review, Giulia Zennaro, Giulio Corazza & Filippo Zanin (2024)

- Integrated Reporting As A Governance Mechanism: Evidence from Global Perspectives, D.F. Lestari (2025)

END

Words: 1,472

For further information contact:

Terrance M. Booysen (CGF: Chief Executive Officer) - Cell: +27 (0)82 373 2249 / E-mail: [email protected]

Jené Palmer (CGF: Director)) - Cell: +27 (0)82 903 6757 / E-mail: [email protected]

CGF Research Institute (Pty) Ltd - Tel: +27 (0)11 476 8261 / Web: www.cgfresearch.co.za

Follow CGF on X: @CGFResearch

Click below to read more...