A tale of two Company Secretaries

Imagine two Company Secretaries on the eve of a critical board meeting. Both face the same question from their Chairperson: “Are we well governed?”

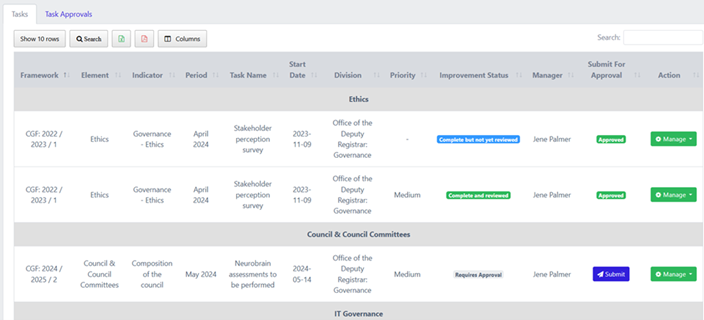

One scrambles through outdated folders and spreadsheets deep into the night, desperately chasing confirmations and approvals. The other calmly reviews a live governance framework dashboard on their screen, with every governance indicator, policy status, and risk exposure presented clearly in real time. (Figure: 1)

The difference between these two scenarios is not luck or individual brilliance. It’s the presence -- or absence -- of a digitised governance framework.

The illusion of control

In countless organisations, governance still lives as a paper ritual with static policies, annual compliance checklists, and carefully curated board packs designed to reassure rather than reveal. But behind the scenes, chaos often lurks, and the board is completely unaware. Outdated policies, blind compliance gaps, and delayed decisions create only the illusion of control. Boards nod approvingly at over loaded board packs, and glossy integrated annual reports filled with generic assurances, blissfully unaware of any ticking bombs.

When trouble eventually erupts -- and these days it is happening more often than not -- we hear the same tired narrative: “We didn’t know,” “It wasn’t escalated,” or “The information was incomplete.” By then, the damage is done - reputationally, operationally, and financially and then the finger-pointing and blaming starts.

A new dawn for the Company Secretary

Then there’s the digitised governance framework: an on-line governance tool developed to transform governance from a static checklist into a living, breathing system for those charged with governance. When a Company Secretary leverages a platform like Praefectus™, they are no longer simply coordinating board packs or chasing policy updates. In alignment with King IV™ [Principle 10 and Recommended Practices 47 - 51] and the UK Corporate Governance Code [Provision 14], they become a strategic navigator who empowers the board with real-time insights across all governance matters affecting the organisation. Equipped with live governance dashboards, they can immediately identify areas of strength and vulnerability, proactively cue on interventions, and support the board in preventing issues from escalating into crises, thereby enhancing overall board effectiveness and organisational resilience.

Critically, digitisation dissolves the historic tension between the Cosec and the executive team. Instead of operating in silos or working from fragmented data, they share a single version of the truth. Suddenly, everyone charged with governance -- from the Board, the executive and Cosec to the audit and risk committee -- is looking at the same real-time governance landscape. They are no longer debating outdated reports or historical gaps; they’re facing the present reality together and steering confidently into the future.

What about the unexpected surprises or the defensive scrambling? These reactions are replaced by proactive clarity. Trust and alignment replace tension, enabling the board and executives to act as a single, united force, allowing them to focus on what truly matters.

True agility, beyond the boardroom

The benefits of digitised governance extend far beyond board packs and meetings. Executives gain immediate insight into strategic and operational performance, including the effectiveness of risk and compliance management. Resources can be reallocated more quickly to address vulnerabilities that plague the organisation’s value generating activities. Identified governance risks are addressed decisively, while emerging threats are identified and mitigated early. This agility is transformative. Instead of crisis management, organisations move into proactive governance that provides real sustainable value to the business and its leadership. Instead of scrambling to defend the organisation and its board’s reputation, the leadership builds trust through transparency and rapid improvement.

One example, many ripples

This example of the Chairman’s question posed to the Company Secretary --“Are we well governed?” -- focuses on one person or their department. But imagine the same level of thinking and empowerment extended across the organisation’s entire governance landscape.

Through a digitised governance framework, each of these leaders -- from the risk manager to the compliance officer, IT head, and strategy team -- is empowered with a shared, real-time view of governance across their domains, enabling them to act proactively, close gaps swiftly, and support the board with unified, evidence-based insights. This shared visibility ensures that all those charged with governance (TCWG) are aligned, confident, and able to steer the organisation collectively and decisively.

Operating in their own domains yet feeding into a single, connected framework, their individual work strengthens the collective whole, creating a dynamic system where information flows, gaps close quickly, and no one is left guessing about the true state of governance across the organisation.

Reimagining trust with stakeholders

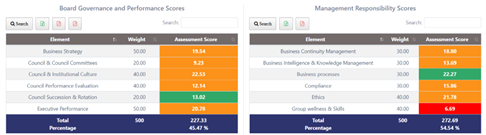

Imagine how stakeholders -- shareholders, investors, regulators, partners, employees and customers -- would respond if they knew that governance weaknesses were not hidden but tracked, prioritised, and actively addressed. Imagine an organisation that does not publish a glossy integrated report full of marketing spin, but one that says, “Here’s exactly where we’re strong. Here’s where we’re vulnerable. And here’s how we’re fixing it - now.” Stakeholders don’t expect perfection; however, they do expect integrity, responsiveness, and a commitment to continuous improvement. A board that can show governance maturity within its ranks and indeed the organisation, in real time, earns confidence (Figure: 2). Investors back it, regulators respect it, and employees rally behind it. Moreover, digitised governance frameworks serve as a powerful early-warning system that can help organisations pre-empt regulatory investigations and stave off shareholder scepticism.

By providing real-time evidence of compliance, ethical conduct, and risk mitigation, boards can avoid costly fines, enforceable undertakings, or activist interventions that often arise when stakeholders lose confidence. Instead of reacting to crises under external pressure, organisations can demonstrate that they are proactively addressing governance risks before they escalate - an approach increasingly expected by global regulators and institutional investors alike.

The boardroom litmus test

When the board meeting dawns, one Company Secretary shares a curated, optimistic summary aimed at reassuring the board. The board nods, unaware of the risks lurking in the shadows. The other Company Secretary presents a live governance framework dashboard that is transparent, evidence-backed, and brutally honest. The board falls silent at first - then shifts to the real question: “What do we need to do to fix this now?”

That moment is the difference between passive oversight and true stewardship. Between reactive firefighting and strategic leadership.

Costs avoided, confidence gained

We need to dispel the myth that digitised governance is an overhead - it is an investment in resilience and future growth. The costs saved by preventing governance and compliance failures, avoiding fines, and steering clear of reputational disasters far outweigh the price of any governance technology. Consider the following publicly cited examples: after Siemens was embroiled in a $1.6 billion bribery scandal, they invested heavily in overhauling their compliance and governance structures, introducing stronger global processes, stricter controls, and supporting technology systems. Today, they are often cited as a case study of ethical recovery and cultural transformation. In contrast, Volkswagen’s ‘Dieselgate’ emissions scandal which cost the organisation over €30 billion, underscores how weak oversight and the absence of transparent systems can devastate even the most iconic brands.

Globally, many organisations refer to governance codes like King IV™, the UK Corporate Governance Code, or OECD governance framework standards, but these references are too often superficial. Annual reports showcase glossy governance claims of compliance but provide little -- if any -- evidence of real-time application, oversight, or assurance. Digitised governance frameworks change that, they transform governance from a retrospective reporting exercise into a living, real-time discipline (Figure: 3). They make it possible to see clearly, understanding where the organisation is strong, where it is vulnerable, and what interventions are needed before issues escalate. Moreover, global regulators such as the UK’s FCA, the U.S. SEC, Singapore’s MAS, and Australia’s ASIC highlight the value of real-time data in pre-empting compliance failures and reducing penalties. When assurance is embedded in every task, every day, confidence and performance escalate. Word soon spreads internally and externally showcasing the organisation as one that clearly recognises its purpose and acts boldly. Companies such as Unilever, Microsoft, and Novo Nordisk -- despite facing their own governance controversies over the years -- have demonstrated that embracing strong governance, addressing failures transparently, and continuously improving their governance can drive market trust, strengthen resilience, and support sustained long-term growth.

The call to action

Governance isn’t about appearing flawless - it’s about being real. It’s an ongoing process that, with collective commitment, improves every day. Boards, executives, and Company Secretaries must choose: will you keep hoping for the best, or will you lead with clarity and courage?

The tools exist. Digitised governance frameworks exist. The real question is: will we use them to transform governance from static theory and ‘tick-boxing’ into a living, dynamic practice?

The day the board wakes up is the day governance 2.0 becomes real - when governance is no longer seen as a separate function or inhibitor to doing business, but as something that permeates every fibre of the organisation, influencing every decision and action. The day the board wakes up is the day it stops merely preventing failure and starts enabling success - when governance becomes a dynamic, outcome-focused driver of value, rather than a static barrier. That is the day stakeholder trust begins to rebuild.

For more on digitised governance frameworks and how they empower true agility, visit www.praefectus.co.za or contact us at: [email protected]

ENDS

Words: 1,551

Sources:

King IV™ Report on Corporate Governance for South Africa 2016 (The Institute of Directors in Southern Africa)

UK Corporate Governance Code

U.S. Department of Justice, Siemens AG Agrees to Pay $1.6 Billion in Global Bribery Settlement (2008)

Siemens AG Compliance Report and Code of Conduct updates

For further information contact:

Terrance M. Booysen (CGF: Chief Executive Officer) - Cell: +27 (0)82 373 2249 / E-mail: [email protected]

Jené Palmer (CGF: Director)) - Cell: +27 (0)82 903 6757 / E-mail: [email protected]

CGF Research Institute (Pty) Ltd - Tel: +27 (0)11 476 8261 / Web: www.cgfresearch.co.za

Follow CGF on X: @CGFResearch

Click below to read more...